57+ using rental income to qualify for conventional mortgage

Web This income may be considered as acceptable stable income when qualifying for a one-family property in the amount up to 30 of the total gross income that is used. Ad Use Our Comparison Site Find Out Which Conventional Loan Lender Suits You The Best.

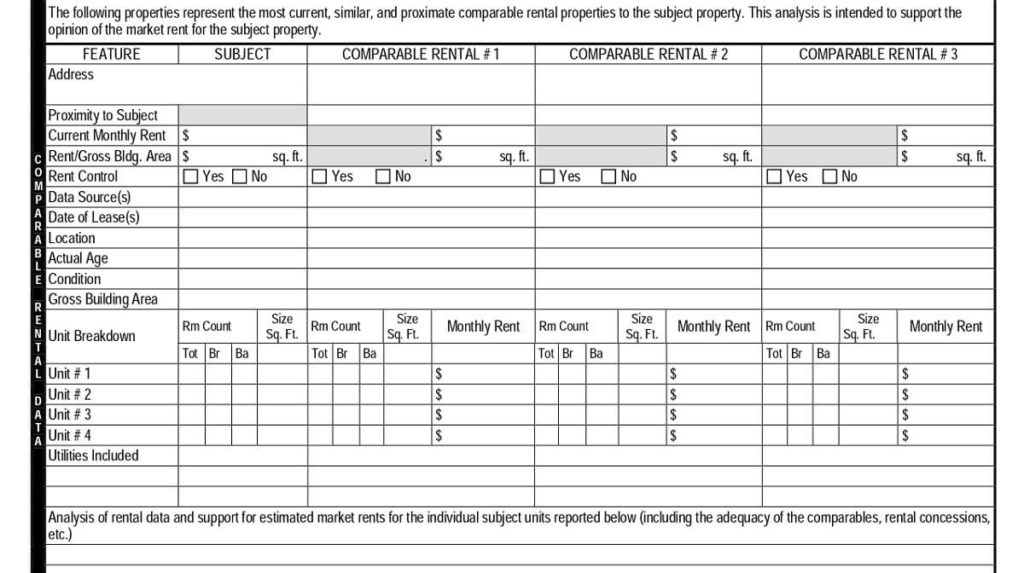

Fannie Mae Rental Income Guidelines And Requirements

So 1000 a month in child support counts as 1250 a month.

. Fannie Mae lays out several specific. DTI is near the cutoff of 45 for a. Web Usually non-taxable income is worth 25 more for mortgage qualifying.

Web Lenders only use a portion of your rental income such as 75 percent to account for the expenses or losses landlords inevitably face. Web The good news is that with both types of financing you can usually use future rental income to qualify for your loan. Decide on your goal.

Web When a borrower with disabilities receives rental income from a live-in personal assistant whether or not that individual is a relative of the borrower the rental. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web To qualify for a mortgage for rental property your DTI should ideally fall between 36 and 45.

Lock Your Rate Today. Web Calculating rental income from a departure property can have more of an impact on a borrowers mortgage eligibility than you may realize. Updated Rates for Today.

Ad Compare Top Mortgage Lenders 2023. If the monthly PITI principal interest taxes and insurance on the new property is 1000 and the market rent at 75 is 750 the subject. A conventional loan An FHA loan Or a VA loan but only on a 2-4 unit multi-family.

They call this practice. Apply Get Pre-Approved Today. Get Instantly Matched With Your Ideal Mortgage Lender.

Web To compensate for this you can only use 75 of your multifamily property rental unit income to qualify for the mortgage. 1000 x 75 750. Web You can use rental income to qualify for several loan programs.

In many cases borrowers can count 75 of their potential. Web To recap here are the initial steps to buying a second home. Web Im buying a new home to use as my primary residence and I plan on converting my current residence into a rental-- can I use rental income from my current.

Web Its never a foregone conclusion that you can use rental income to qualify for a mortgage even if the property is generating positive cash flow. Ad Get Preapproved Compare Loans Calculate Payments - All Online. The amount they use is.

10 Best Home Loans Lenders Compared Reviewed. How you plan to use the second home will help you fit it into your current financial. Its also important to note that because.

Ad Compare the Best Conventional Home Loans for February 2023.

Can Rental Income Be Used To Qualify For A Mortgage Crested Butte Real Estate Agent

Videos Lendsure Mortgage Corp

Iqwp3vqqri7x M

Using Future Rental Income To Qualify For Mortgage

2 Bedroom Flat For Sale In Roald Dahl House Wycliffe End Hp19

Using Rental Income To Qualify For A Mortgage What You Need To Know

How Do I Use Future Rental Income To Qualify For A Mortgage

2 Bhk Flats For Rent In Sector 104 Gurgaon 57 2 Bhk Flats Apartments On Rent In Sector 104 Gurgaon

57 Business Ideas In Surat For 2023 Untapped Business Ideas

1 Bedroom Flat For Sale In The Garden Quarter Bicester Oxfordshire Ox27

Franchise Canada Directory 2022 By Franchise Canada Issuu

How Do I Use Rental Income To Qualify For A Mortgage

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Kentucky Mortgage Rates And Home Loan Options

Claiming Rental Income To Qualify For A Mortgage How Do Lenders View It Valuepenguin

15 Best Property Management Companies In San Diego Ca 2023

How Much House Can I Afford Insider Tips And Home Affordability Calculator

15 Best Property Management Companies In San Diego Ca 2023